Introducing Thrive, our new financial literacy program!

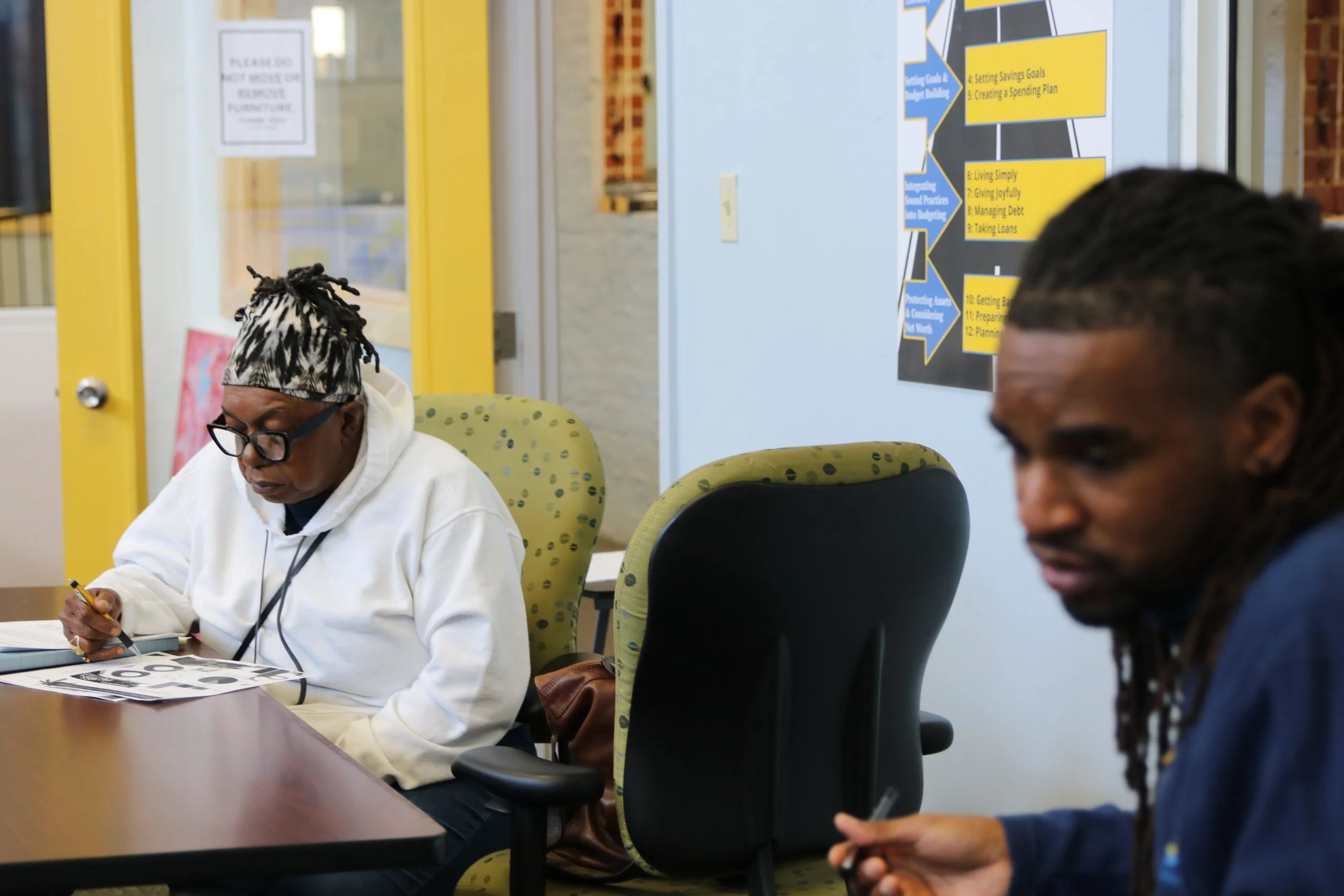

Ann Mimms (left) recently graduated from Thrive. She says the course has encouraged her to strive for loftier financial goals and that she "would recommend it to anybody."

There’s a piece of South Third Street where a TitleMax, an ACE Cash Express, and a pawn shop sit within 500 feet of each other.

Our neighborhood is a national leader in bankruptcies, as our neighbors are regularly pressured into bad financial decisions. And a lack of financial literacy often leaves our neighbors fighting to survive crisis after crisis.

Advance Memphis has been teaching money management classes in South Memphis for almost our entire history. In recent years, this has been through Faith & Finances, a course that meets on Thursday evenings and lasts 12 weeks.

But for many of our busy neighbors, a 12-week course is too burdensome.

To meet our neighbors where they’re at, our financial literacy instructor Michael Johnson launched a new, accelerated money management class in December. Named “Thrive,” the class only lasts 4.5 hours over three class sessions and is offered at various times, allowing our neighbors to fit it into their busy schedules.

Thrive is limited to six students per cohort. This gives our staff the chance to have deeper conversations with students about their relationships with money, their financial challenges, and their goals. Our neighbors leave with practical advice for facing their specific financial challenges.

“I had 1,001 questions and (Michael) answered every single one of them,” said Thrive graduate DeLisa Gant-Williams. “I enjoyed … learning different ways of investing (my) money.”

Gloria Wright, another of Thrive's 21 graduates, said the class helped her understand credit card interest rates and taught her to manage her spending more carefully.

“I was overspending, buying (stuff) I didn’t need or buying too much of it,” Wright said. “I’m learning to be a good steward.”

Once students have completed the 4.5 hours, they are enrolled in an incentive program where they can earn cash rewards for building their credit, saving money, paying off debt, or furthering their education. This will keep us in contact with our neighbors following their graduation, allowing us to offer encouragement and support with whatever challenges arise in their lives.

We're looking forward to seeing more of our neighbors meet their financial goals.